Unionizing Against Uber

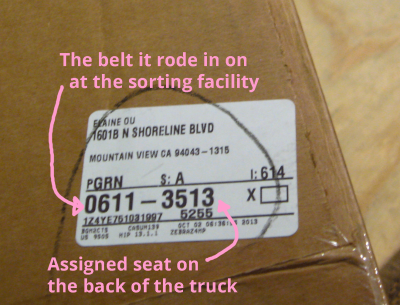

When I became a UPS employee, I had to pay a $35 fee to join the Teamsters Union. I wasn’t employed long enough to even recuperate my union fee, but that is a story for another day.

At UPS, the drivers, loaders, and dockworkers all work for the labor union. Only the managers and supervisors actually work for UPS, Inc. The unions formed because laborers need to organize to wrest their fair share from greedy corporations. Those aren’t my words; that’s in the Teamsters’ Mission Statement.

Last week, I met a former UPS supervisor.

“Those Teamsters were the worst,” he said. “They knew which boxes had iPhones and shit from the packaging, and would hide them behind fake walls and steal them. I had to break up several theft rings.”

I guess this was part of the Union’s mission to wrest their fair share from greedy corporations.

This past weekend, with the help of Teamsters, Uber drivers banded together to form their own labor union.

Uber was supposed to be a neutral platform, a portal to a liberated marketplace unimpeded by the taxicab tyranny. Uber even calls its drivers “partners”. Partners with no equity.

Uber drivers work for themselves, but only in the sense that Uber does not provide a commercial insurance policy and drivers are legally culpable in the event of an accident.

Uber does help with things like financing luxury vehicles. A large proportion of Uber drivers are former taxi drivers with scant savings. They can’t afford the towncars needed to drive for UberBLACK.

At the SHARE conference, a Lyft representative described how Lyft was empowering underserved consumers by providing them with access to vehicle financing (but only for luxury SUVs). Clearly what underprivileged consumers need are Ford Explorers and Cadillac Escalades so they can get their kids to school like ballers.

To qualify for Uber’s financing program, the driver must have an active signed “Payment Deduction Authorization Agreement” and must make 90% of their monthly payment from Uber earnings. As a result, supposedly self-employed drivers lock themselves into 5 years of indentured servitude to the tune of $50k.

Meet the new boss. Same as the old boss.

In other news, Uber is now valued at $10 billion.