How RadioShack Became Too Big to Fail

If you owe the bank $100 that’s your problem. If you owe the bank $100 million, that’s the bank’s problem. –J. Paul Getty

I’ve always wondered how RadioShack (RSH) stays in business. Warren goes there once a year to buy a fuse for his ham radio or some crap, but that leaves the store with $840M in debt, $43M in cash, and very negative margins.

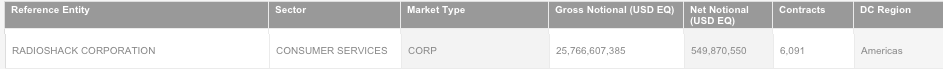

The good news is that there is a $25.7B market for RSH credit default swaps. Credit default swaps were originally created so that a company’s creditors could buy insurance in case the company couldn’t pay back its debt. But just like life insurance, anyone can buy a CDS on anybody (as long as there’s a seller).

Now some third parties stand to gain $25.7 billion if RadioShack decides to go under, which is kind of like 31 people holding life insurance policies on your mother, if your mother was RadioShack.

The contract sellers don’t want to pay out $25.7 billion, so they went ahead and loaned RadioShack more money to keep it on life support. At this point I suspect that Radio Shack would just like to be put out of its own misery, but the counterparties are hedge funds with lots of money.

I guess the moral of the story is, if you’re gonna take on debt, take on enough debt that someone out there can’t afford to see you fail.

See Also:

RadioShack Kept Alive by $25 Billion of Swaps Side Bets –Bloomberg