Frictionless Investments for Sophisticated Investors

Yesterday I asked a Silicon Valley angel investor what he thought of BitBox*.

According to AngelList, you are an investor in BitBox. is what I said.

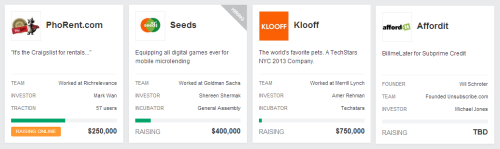

Oh, he said. I’m sorry, I don’t remember what BitBox does. I must have thought they had a good team. AngelList makes it way too easy to invest in companies.

Apparently AngelList is the new Tinder, where you can flip around and make noncommittal investments from the comfort of your toilet seat.

AngelList’s frictionless investment experience reminds me of Robinhood, whose founders have been criticized for making trading *too* frictionless. After all, active trading generally leads to underperformance. But Robinhood’s founder says, Young people can afford to lose a few hundred dollars, that’s the equivalent of “Oh crap, I dropped my iPhone in the toilet.”

Robinhood’s progressive premise: If you are rich enough to afford an iPhone (and their app is iPhone-only), you can afford to lose all your money in the stock market.

It’s the same rationale behind the SEC’s requirements for accredited investors: You must be rich enough to be able to lose a small fortune before you can be an angel investor.

If trading stocks on Robinhood is the equivalent of dropping your phone in the toilet, then I guess writing off an angel investment is the equivalent of, Oh crap, I dropped my Tesla Model S in the toilet.

Woops!

*Company names have been changed.