Crowdsourcing the Race to the Bottom

I just received this email from Postmates advertising flower delivery in San Francisco. Within the hour. For $19.95. Delivery and tip included. That’s pretty darn cheap.

Yesterday, Warren told me about another startup, BloomThat, that also delivers flowers. Ridiculously fast.

Why are they doing this? What problem are they trying to solve? Did your wife come home from work in the middle of the day and catch you in bed with the housekeeper, and now you need to send flowers, Ridiculously Fast, before she storms back to the office?

Exactly how big is this market, anyway?

As for the $19.95 flower delivery, they can’t possibly be turning a profit, or even breaking even. Operating at a loss to build hype is the same strategy employed by every failed business that ever patronized Groupon.

As of Monday, startups can publicly solicit funds from investors. You can gauge the quality of these crowdsourced startups for yourself on sites like AngelList. Yes, investors are actually putting money into these things.

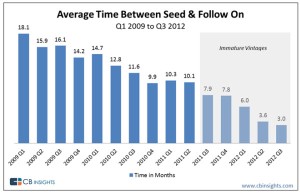

You see, this is what half a decade of Zero Interest-Rate Policy does to the country. Thanks to Bernanke, we now have USB-powered sex-toy startups closing multimillion-dollar rounds.

These are all real listings on AngelList. BillMeLater for subprime credit? That’s a winner!