Your Twitter Followers are Probably Bots

The New York Times had an interesting feature over the weekend in which it calls out various social media influencers for follower fraud. Many people who appear to have huge Twitter followings actually don’t, and their fans are in fact paid-for bots. Oooh, busted! Apparently there’s a class of people who make a career out of being popular on Twitter, and it is terribly scandalous that they are not as cool as they might seem.

NYTimes identifies a person’s fake followers by examining the account creation date of each follower, and plotting the order in which they followed the target user:

For example, this is Twitter board member Martha Lane Fox. She gained tens of thousands of followers in 2016 and 2017, and it’s super obvious which ones are fake. A bulk bot purchase shows up as a large influx of followers, all with similar account creation dates (horizontal lines in the above plot).

The NYTimes analysis is compelling, but their target account selection was awfully limited. So I reproduced their Twitter tool to continue the investigation.

First, I ran the tool on my own Twitter account and charted my followers:

See that clump on the left? My first thousand followers were all bots. I know this, because I made them myself. For the first several years of my Twitter existence, the only people I interacted with were bots. Didn’t realize the platform could be useful for humans until 2016.

My account isn’t too interesting, because I don’t have many followers. The NYTimes neglected to conduct the fake-follower analysis on any of their own staffers, so for the sake of journalistic objectivity, let’s look at NYTimes columnist @paulkrugman.

Paul Krugman has over 4 million Twitter followers. It would have taken forever to download the entire list, so here’s a plot of the most recent ones:

Over the last 3 days, @paulkrugman gained over 20,000 followers, and nearly all the accounts were created just minutes before the follow. That’s the solid horizontal line you see across the top.

Who are these mysterious users who join Twitter and immediately follow @paulkrugman? Let’s have a look:

I’m gonna guess that approximately zero of these accounts belong to real people. This is not to imply that Paul Krugman paid for his followers – many bots automatically follow popular accounts upon creation. Every chart we generate will show a concentration of followers created at the most recent date. If you have more than a few thousand followers, you probably get a lot of bots too, whether you pay for them or not.

Fake followers are nothing new, and mostly harmless. But for whatever reason, New York attorney general Eric Schneiderman was concerned enough that he opened an investigation into the matter. You’d think he’s never used Twitter before, except that he’s had an account since 2010.

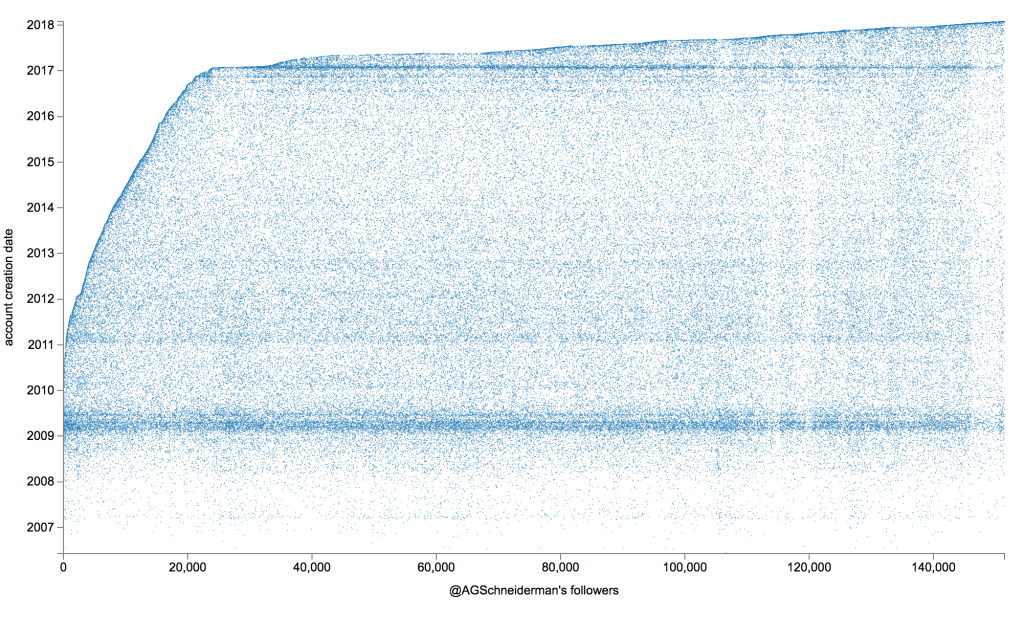

While Attorney General Schneiderman is busy chasing bots on the internet, let’s have a look at his Twitter followers:

@AGSchneiderman acquired 25,000 followers from the date he joined to the end of 2016. While the initial growth looks organic, his account suddenly gained over 125,000 followers during 2017. Of those 125,000, a significant number created their accounts within days of each other. This shows up as a solid horizontal line during the last week of January 2017.

Fascinating! It would appear that Attorney General Schneiderman has a lot of fake followers himself. I hope he includes this analysis in his investigation.

Note:

You, too, can help Eric Schneiderman solve the mystery of the fake Twitter accounts! The script for generating Twitter-follower plots is available here.