(This is an abridged response to a comment in my mailbox.)

I get that humans are hunter-gatherers and there’s a natural instinct to collect random bits and bobs, but it’s not the *collection* that has value; it’s the *discovery*. Cryptokittes were sort of fun because you could breed two cats and hatch an egg (wtf), and the result was a surprise. It took a modicum of effort to find a rare Kitty.

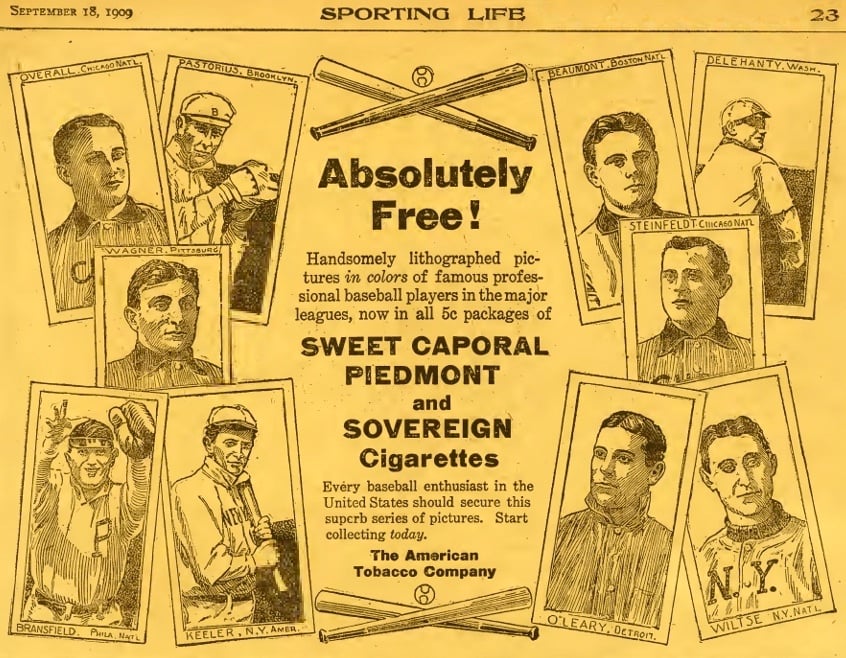

Humans love surprises; that’s why slot machines are so addictive. And that’s why baseball cards became popular. Kids would go to the corner store for their daily pack of cigarettes, and maybe there would be a Honus Wagner card inside the package. The modern-day equivalent might be the Pokemon toy you get in a McDonald’s Happy Meal. The cigarettes were probably healthier, but McDonald’s prizes are better.

We admire someone’s art collection, or baseball card collection, because it represents a proof-of-work. There’s something impressive about seeing the complete set of McDonald’s Pokemons. Like, someone plowed through a LOT of cheeseburgers to acquire that collection.

The liquidity of NFTs ruins the fun of collection, in that it cheapens the discovery process. Friction has value; that’s why Shopify is able to exist in spite of Amazon.

But maybe I’m jaded by post-capitalism. Back in the olden days, money was a sort of proxy measure for work, so a display of wealth was in theory a proof-of-work. Now that money magically arrives in the form of stimulus checks, does work even have value?

See Also:

Bitcoin as a Display of Wealth

Excellent comment. Only thing is when I was a kid in the late 1940’s. the baseball cards were included in a pack of gum, not cigarettes.

ah, you’re a young’un.

I’m vaguely reminded of the joke by Niklaus Wirt that the Germans call him by his name but the Americans call him by his value…

ps: regarding the previous post, which I was too busy to comment about, for a long while I thought that the futures market was used as a sophisticated form of money laundering, which let people turn inside information (i.e. such and such a stock was going to go up or down) into cash via leveraged trades. I imagined this would work especially well if one were getting these telegraphed pieces of information about the sales or purchases of a sovereign wealth fund.

BUT as per the whole discussion from last week re; counterfeit stocks in short sales, even _that_ looks too small potatoes these days.

Regarding other forms of speculation… if the powers-that-be weren’t so hostile to real-world work maybe they wouldn’t be driving capital into digital speculation. Heck, I understand that dry cleaning fluid, to take one example, is much more regulated now that it used to be. The statists like to complain about speculation but their war on stuff like dry cleaning is one of the main causes of the speculative bubble, because the way you lose money is by trying to build a real world factory with it.

Last week… Ugh. I meant the stuff around the end of January/beginning of Feb.

I’m losing track of what week it is.