During times of volatility, Bitcoin hodlers like to repeat the meme that 1 BTC = 1 BTC. The tautology serves as a reminder that Bitcoin has a finite supply, and once someone has accumulated a fraction of outstanding bitcoin-denominated wealth, that status will never be diluted.

Ideally we live forever in immutable luxury, but that’s unattainable for most. In the absence of immortality, the next-most extropian thing to do is transfer socioeconomic status to the next generation.

What’s the best way to bequeath status? Elite universities were originally created to preserve the aristocracy. In the early days, an esoteric exam was used as a proxy for family background, because only the wealthy could afford a prep school education. (Here are Harvard’s old entrance exams. Anyone who could pass was admitted.)

The growth of public high schools democratized exam knowledge, so today universities employ “holistic” admissions criteria to determine who belongs in the upper crust. Legacy applicants still receive extra consideration because the entire purpose of college is to provide a means of intergenerational status transfer. Universities can’t come right out and say that, of course, because then they would lose their tax-exempt status.

Besides, institutionalized inequality only works if you convince the underclass to play along. People are generally willing to accept a loser lot in life if they believe their kids have a shot at something better — that’s why highly educated immigrants come here to be cab drivers. The US is so good at convincing people of its meritocracy that even the homeless see themselves as temporarily embarrassed millionaires.

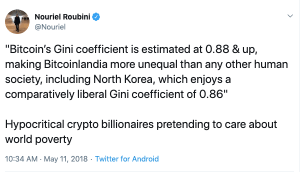

Nocoiners point to Bitcoin’s finite supply as evidence of institutionalized inequality. There’s no inflation to accommodate newcomers or economic growth, so the HODLers will HODL their way to prosperity while everyone else stays poor!

Sadly, Bitcoiners are but mere mortals, and at some point they will need to buy food and shelter. Worse yet, they may procreate, and reproduction is pretty much the greatest destroyer of socioeconomic status. Assuming more than one offspring, each member of a successive generation ends up with a fraction of the parents’ wealth. Unless the kids find a way to augment their HODLings, they’ll eventually descend into poverty.

If you want to increase your wealth, you can either (1) create something of value to others; or (2) convince people that your assets are worth more than they already are.

The second option is easier than the first — that’s where fiat comes in. A dollar is always worth a dollar, but the most useful feature of the dollar is that banks can make certain things worth *more dollars* by pointing and lending. Make it easy for homeowners to borrow money, and housing prices will go up. Make it easy for students to borrow money, and tuition costs will go up. Make it easy for corporations to borrow money, and stock prices go up. Stocks, real estate, and a college degree have been the greatest investments of the century because bankers live to pump their own bags.

Seems like a good moment for your periodic reminder that Janet Yellen has a net worth of $13m+ and Jerome Powell a net worth of $100m+. https://t.co/lGbuHzsEps

— Ben Hunt (@EpsilonTheory) July 9, 2018

Modern wealth preservation depends on making some assets artificially scarce and dollars artificially abundant. It would have been easier to just use Bitcoin, but then central bankers might have to actually create something of value.

I mostly agree with you on this one. But once in a blue moon, investing (could be fiat or bitcoin) in a corporation does lead to real economic growth for everyone.

True! Buying stocks isn’t “investing in a corporation” though — you’re buying from some other stockholder on the secondary market. IPOs and other issuances go to the corporation, but aren’t accessible to retail investors 🙁

Elaine, could you use your old Harvard creds to access those early exams? (Curious as to the content, and I’m unable to request a scan.)

(P.S. You’re a 10.)

doh! it’s an actual physical book you have to go check out in Cambridge. Here’s one that someone scanned though 🙂 https://elaineou.com/wp-content/uploads/2019/07/harvard-admission-1899.pdf