Software was eating the world, and a revolutionary stock brokerage wanted to provide services for younger, tech-savvy clientele. The target investor class was different from their parents. They would rather look at a screen than Talk to Chuck, and they didn’t trust existing financial institutions.

In a world that was accustomed to $20 trading commissions, this fantastic new company was offering trades for free. It was 1999, and the founders of Robinhood were still in diapers when Freetrade introduced zero-commission trading to a new generation of investors.

Freetrade couldn’t have come at a better time. A dotcom bubble was brewing, and people were quitting their jobs to daytrade tech stocks.

The web brought streaming quotes to the browser, and discount brokers enabled real-time reactions. Back when a trade cost as much as the new Backstreet Boys CD, retail investors weighed their options carefully before placing an order. But when trades became free, people flipped stocks with abandon.

Freetrade shut down in 2005 due to an unsustainable business model.

A decade later, free trades are back, and this time it’s mobile-first.

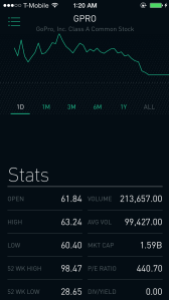

Robinhood has a mission to democratize access to the financial markets. The app feels like a toy. Companies are distilled into a minimal set of “Stats”, so we can balance our portfolios much like we draft our fantasy football lineups.

I suppose I could pull up my Bloomberg terminal if I wanted to do some research before making an investment decision, but I feel like that’s not in the spirit of this app. Howard Lindzon, founder of Stocktwits and one of Robinhood’s early investors, says that placing orders with a flick of a thumb makes him feel like a rock star.

I think it’s great that Robinhood is encouraging millenials to take an interest in their financial future. But maybe the financial markets shouldn’t be quite so democratized. Maybe if Scottrade’s $7 commission is enough to impact your return, you shouldn’t be buying stocks. Maybe if you’re not willing to expend more than three taps per trade, someone else should be responsible for your portfolio.

Complain all you want about how Charles Schwab is swindling commissions from your account — trading fees force you to exercise a little more patience and selectivity when making investment decisions. You might not feel like a rock star, but how often do you think Warren Buffett needs to feel like a rock star?

Epilogue

After Freetrade went out of business in 2005, a startup called Zecco Trading launched another zero-commission brokerage. 16 months later, Zecco stopped offering free trades and got acquired.

One thought on “Robinhood (part 1): Feeling Like a Rock Star is not a Trading Strategy”