A recent study from UBS Wealth Management Americas shows that kids aged 21 to 36 have 52% on average in cash.

Unless you are about to buy a house, execute a major drug deal, or flee to Mexico, there is no reason to have 52% of your assets in cash.

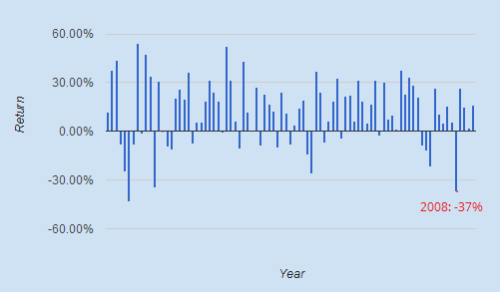

Young people avoid investing in stocks because they endured the dot-com crash and financial crisis in their formative years. The market seems risky.

Holding cash would have beaten the market in 2000, 2001, 2002, and 2008.

But holding cash is equivalent to investing in a negative-yield bond. This cash holding would have underperformed the S&P 500 by 30% last year. An investor who chooses this zero-return strategy runs a risk of not being able to save enough for retirement.

People often confuse uncertainty and risk, when the option with the most certainty is often the riskiest. A cash allocation is a certainty that depreciates at the rate of inflation.

Higher education is also a frequently-mistaken risk aversion strategy. There is a lot of certainty associated with an advanced degree. An engineering PhD at least guarantees you a six-figure salary at a boring company.

However, just as a 0% return ended up being a really lame outcome for 2013, a career at Intel might end up being a really lame outcome for an EE PhD. By choosing a low-risk strategy for six years, the PhD student gambled away the most priceless asset of all.

Sometimes the biggest risk is to not take any.