The Impact of Derivatives Trading on Bitcoin Spot Market Volatility

Bitcoin fell another 14% against the USD this past month. Or maybe bitcoin held steady as the dollar rallied. Depends what universe you live in.

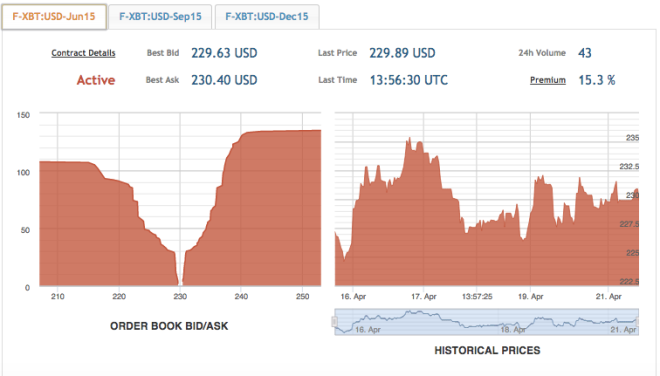

Last week, Silicon Valley Meets Wall Street panelists theorized that the introduction of derivatives markets would reduce bitcoin price volatility.

Do highly-leveraged bets stabilize their underlying markets?

Options and futures expiration dates see increased trading volume and volatility. Investors have to close out of their positions, sometimes options holders try to push underlying prices in their favor, or some take stock positions to hedge their options exposure.

Enough speculation. Let’s look at historical markets following the introduction of derivatives trading. I read all this shit so you don’t have to.

| Markets | Effect on volatility | Reference |

| Kuala Lumpur Stock Exchange | increase | Pok & Poshakwale 2004 |

| Korea Stock Exchange | increase | Bae, et al 2004 |

| Spanish Stock Market | decrease | Pilar & Rafael 2002 |

| Italian Stock Exchange | decrease | Bologna & Cavallo 2002 |

| Indian Stock Market | decrease | Bhaumik et al 2008 |

| Athens Exchange | decrease | Alexakis 2007 |

| Crude oil | no effect | Fleming & Ostdiek 1999 |

| Dow Jones Industrial Average | no effect | Rahman 2001 |

An oft-cited reason for decreased volatility is due to the increase in information efficiency. But maybe it has something to do with the fact that most of these are emerging economies. If a country is undergoing such a period of progress that it is introducing a futures market, the economy is probably stabilizing.

Hence the lack of effect in more-established markets (DJIA, crude oil).

Similarly, most cases of rising volatility are associated with disruptions in the underlying economy. The Asian financial crisis of the late 90s surely had some effect on Malaysia and Korea.

Anyway, Bitcoin. TeraExchange was the first CFTC-approved swaps exchange, but BTC derivatives are still nascent. Bitcoin volatility will decrease. Maybe from derivatives trading, or maybe bitcoin adoption spreads and we see increased liquidity. Or maybe everyone gives up on bitcoin and prices stabilize at zer0.