An earlier post made it sound an awful lot like the options market is merely a gambling establishment. It is. When trying to decide whether or not something counts as gambling, ask if it’s a zero-sum game. That’s a pretty good way to tell.

Options are bets where a seller has to pay a buyer money if a specific event happens in the market. The amount of money in the system stays the same. By replacing the word bet with derivative contract, and by using the verb speculate instead of gamble, options traders operate under a special set of laws where gambling is legal.

What about the stock market? Is it a zero-sum game?

You and I each have $100. I buy one share of Virgin America (VA) at IPO for $23. I now have $77. I sell it to you for $33. I now have $110. You have $67 and one share of VA, which has a market price of $33. Your net worth, on paper, is $100. Our combined paper assets have increased by $10 even though the total cash in the economy stays the same.

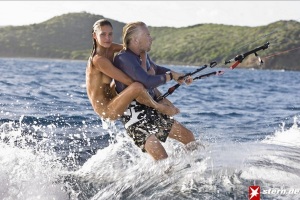

You speculate that Richard Branson will use the original $23 to invest in VA’s future productivity and create a more valuable company. If that happens, more wealth is created in the economy and everyone lives happily ever after.

If Branson instead spends that $23 on hookers and blow, then you just learned an important lesson about the illusory nature of unrealized market wealth.

Keeping with your earlier journalistic advice, a better title for this post would be along the lines of “Rumors that Richard Branson spends IPO money on drugs prostitutes have not yet been confirmed”

OH YEAH good point! I should hire you as my editor!

(Though, unlike me, you would have remembered to include the word “and”).